Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

#15 YEAR FIXED MORTGAGE CALCULATOR FOR FREE#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. To find the best loan, you’ll want to get your credit score in the best shape possible, gather your documentation and use our calculator to get a rough estimate on what you can afford. But you should always compare multiple lenders so you can find the best rate and terms for your situation. You can start by contacting a lender you already have a relationship with, like a checking account or another loan. For some people, that may help offset the larger mortgage payments.

There’s one caveat: in certain circumstances, mortgage interest may be tax-deductible. If you’re interested in building equity more quickly, or if you can swing the larger monthly mortgage payment relatively easily, you should consider a shorter term loan than 30 years. You’ll pay far more in interest costs over the 30-year loan span than you would with a 15-year mortgage. That means the lowest, most affordable monthly payment, which is what many people prioritize.īut that affordability comes with a price. The 30-year, fixed-rate mortgage is by far the most popular for a simple reason: it’s the longest stretch of time most lenders make readily available.

Comparing 30-year Mortgages to Other Loan Terms The lender may also want to see past rent checks or a letter from your landlord as proof that you pay housing expenses on time.Īlso, if you plan to use gifted funds for your down payment, you’ll need to provide a detailed paper trail showing where that money came from. There are other things lenders may require, too, such as a list of all your liabilities, like credit card balances or other loans. You should also expect to provide bank statements for checking and savings accounts, retirement and other brokerage accounts from at least the last 60 days. If you’re self-employed, you’ll need to verify your income with recent 1099s or profit-and-loss statements. You’ll need to show tax returns for the last two years as well as recent pay stubs or W-2 forms. Related: Mortgage Application: What Does It Contain? You’ll need to be able to prove that you have the funds and means to make mortgage payments on time.

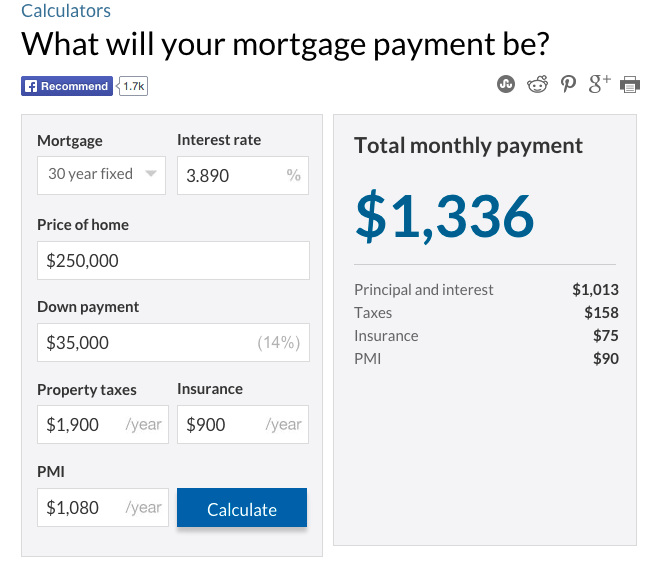

But for many people, the most burdensome part of getting a mortgage is the paperwork. You’ll also need to have a strong credit score to get the best interest rate. There are also closing costs associated with getting a mortgage, typically from 2% to 5% of the loan amount, so it can add up. 30-year Mortgage: Costs and RequirementsĪs of late-July 2022, the average national interest rate for a 30-year, fixed-rate mortgage was in the mid 5% range. Related: You can also use our calculator to workshop different scenarios, such as the length of your loan term, size of your down payment and so on. That is, how long you’ll be paying mostly interest every month and when you start to pay more toward your principal. When you click “calculate” you’ll see a breakdown of your monthly payment, but also an amortization schedule. And while some of these costs may not be built within your mortgage payment, they’re certainly part of your monthly housing budget. These costs, which you can see by clicking on the “additional options” menu, can add up. The calculator also allows you to get a more detailed cost estimate by adding any homeowners insurance, mortgage insurance or homeowners association (HOA) fees you might pay for the house. In the down payment field, you can populate either the amount or the percentage, and the calculator will automatically fill in the other field. To use the calculator, input a value in each of these fields: home price, down payment, interest rate and loan term (years).

#15 YEAR FIXED MORTGAGE CALCULATOR HOW TO#

30-Year Mortgage Calculator: How To Decide While a 30-year, fixed-rate mortgage is the most common-and a 15-year close behind-most lenders will offer a handful of home loans that last for different stretches of time. Our calculator lets you play around with key factors that go into your monthly mortgage costs, such as: house price, down payment amount and interest rate. How to Use the 30-year Mortgage Calculator

0 kommentar(er)

0 kommentar(er)